Last Updated on January 10, 2025 by

Do you want to make your portfolio grow by leaps and bounds? Do you want this growth with the minimum level of risk? If so, you have come to the right place to learn!

Do you want to make your portfolio grow by leaps and bounds? Do you want this growth with the minimum level of risk? If so, you have come to the right place to learn!

In the financial article Smart Investors Know the Sectors, we touched upon Portfolio Management and the benefits of holding two types of portfolios: a Core Portfolio, also called an Investment Portfolio, and an Explore Portfolio, which we refer to as a Trading Portfolio.

Now it is time to talk about the Explore portion of our portfolios, or what we might call our speculative investments. This chapter will provide you with a solid foundation on how to develop the Explore portfolio. You will see why it is judicious to apply a little more rigor in the selection process as the risk on speculative investments is higher, though the returns are also expected to be higher.

There are three main types of analysis that will allow us to select better trades: Trend Analysis, Fundamental Analysis, and Technical Analysis. This article explains Trend Analysis and Fundamental Analysis. We will cover Technical Analysis in the next article.

What is Trend Analysis and How to Use It

When we use Trend Analysis, also called Top-Down Analysis using Charts, we attempt to determine the trends of the markets, what’s current, what is the direction of the market, and what unique offerings, such as new products or services, will be marketed to consumers. We try to pick winners, and of course, to size our investment according to our risk tolerance in case we are not successful.

There are three trends: up, down, and sideways. Up is called “Bullish.” Down is called “Bearish.” Sideways is called “Neutral.”

Bullish Market is a financial market in which prices are rising or are expected to rise (when Bulls attack they thrust their horns up, thus the name Bull Market to describe an uptrend). Bull markets are characterized by investor optimism and the perception that strong results will continue. A typical chart for an uptrend would have higher highs and higher lows:

Bearish Market occurs when prices of securities are falling (when Bears attack they swipe their paws downward, thus the name Bear Market to describe a downtrend). Investors are pessimistic and have a negative outlook that it will continue for some time. A downtrend is known by lower highs and lower lows. This is what the chart will look like:

Sideways Market occurs when the price trend is neither an uptrend nor a downtrend, but rather, it trades horizontally. A sideways chart is known by equal highs and equal lows:

By charting performance, we can determine the trends that markets and stocks are taking. We can apply these graphic measurements of trends to Countries, to Markets, to Sectors, to Industries, and to Individual Stocks.

We can also determine long, intermediate, and short-term trends of the global markets; which areas of the globe are outperforming others; analyze the overall risk, or portfolio heat; and then review which sectors and industry groups we can use to find stocks of companies within those Industries.

We should seek to gain a fundamental understanding of the general market trends prior to performing more detailed Fundamental Analysis.

The Benefits and Rationale of Fundamental Analysis

Fundamental Analysis involves analyzing a company’s financial statements, business plans, corporate health, its management and competitive advantages, and its competitors and markets.

Do you remember the Goal Setting and Budgeting exercises we performed at the beginning of this project? We made goals, time lines, and budgets. We made a Business Plan individually and collectively, for the whole family and for all the members. This same process can be applied to a corporation, and this is what we call the “Fundamentals” for that company.

Fundamental Analysis is performed on historical and present data, with the goal of making financial forecasts which will guide our trading decisions. Fundamental Analysis provides several possible objectives:

- to conduct a company stock valuation and predict its probable price evolution,

- to make a projection on its future business performance,

- to evaluate its management and make internal business decisions,

- to calculate its credit risk.

The intrinsic value of a company is determined on the basis of three aspects of Fundamental Analysis: Economic Analysis, Industry Analysis and Company Analysis. These three types of analysis will determine the true value, or equity, of the company, so we need to become proficient in how to use them.

With the knowledge of the true value of the equity of the company, we can divide that amount by the number of shares of outstanding stock, or shares of ownership in the company. That will explain the true value or the price per share.

To determine the underlying health of a company, we must examine its core numbers: its Balance Sheet, its Income Statement, its earnings releases, and other indicators of economic health.

Shares of companies with strong fundamentals will tend to go up over time, while fundamentally weak companies will see their stock prices fall.

We must also keep in mind that the purpose and objective of a business is to not only create a profit for the owners and shareholders, but to also add value to society and its customers in a certain way by providing specific goods or services. In this light, prior to making trading investments, we should understand:

- What are those specific areas in which the company will satisfy a need of the society?

- What does it do to work towards the betterment of people in society?

- Is it a dharmic enterprise?

- Is it an immoral enterprise?

- Does it provide a real value to society?

- Does it provide a transient value to society?

Ultimately, we will only want to invest in those companies whose value system is aligned with our own. Each of us must use our discrimination.

Interpreting Financial Statements

To gain insights into a company’s financial health, we must analyze its financial statements. There are three primary financial statements that give us information about the company’s performance: the Balance Sheet as of a given date, an Income Statement for a given period of time, and a Cash flow Statement for the same time period.

Balance Sheet

A “balance sheet” presents a picture of how the company’s assets, the value of what a company owns, “balance” against its liabilities, what the company owes. It is a snapshot of the financial condition of a company.

The Balance Sheet has three major sections: assets, liabilities, and equities:

Assets are the business resources of the company. What does the company own?

An Asset is any kind of resource, which helps to empower a company to perform its business.

Generally we speak of things, which have value, for example: land, buildings, machinery and equipment, money, and brand name recognition.

Liabilities, which are often referred to as Creditor Claims, are obligations the company has made to outside parties who have provided resources.

These outside parties may have lent money or sold supplies on credit to the company, and therefore are owed repayment. Remember, these outside parties do not have ownership in the company, but they are creditors.

For example, if we made a down-payment on the purchase of our land and buildings, and make regular payments secured by a mortgage on the property, this would be regarded as a liability.

Anything we purchase with credit constitutes a liability and we have to pay it back. It is similar to how a mortgage on a home would be considered a liability.

Equity, which is sometimes called Owner’s Claims, is simply the difference between Assets and Liabilities. If the Assets are greater than the Liabilities, then the owners of the company have Equity, a stake of ownership, which has positive value. If on the other hand, the Liabilities are greater than the Assets, then the owners of the company owe money to their creditors and are said to have Negative Equity.

This is much the same way that a home owner has positive equity in a home when the market value is greater than the mortgage. But, if the market value is less than what is owed, they are “underwater,” which means they have negative equity.

Let’s look at a sample balance sheet for Apple Co. on March 29th, 2014:

Notice that the Total Assets of Apple equal the Total Claims (liabilities + shareholder’s equity) against the company. This is the “balance” in the Balance Sheet. Here is the equation:

Assets = Liabilities + Shareholders’ Equity

$205,989 M = $85,810 M + $120,179 M

In a fundamentally healthy company, Assets will outweigh the Liabilities, creating a positive equity for the shareholders. Similarly, a company having troubles, or even a start-up company, may have negative shareholder equity.

This is how the Balance Sheet works. Now it’s time to do some calculations. Pull out your calculator and follow along!

Understanding Balance Sheet Ratios

Quick Ratio – A Measure of Liquidity

A figure called the Quick Ratio helps investors determine if a company’s assets and liabilities are in a healthy balance. The quick ratio measures a company’s ability to meet its short-term obligations (called Current Liabilities) with its most liquid assets (called Current Assets). It is calculated as follows:

Quick Ratio = (Current Assets – Inventory) ÷ Current Liabilities

Quick Ratio = ($70,541 M – $1,829 M) ÷ $43,208 M = 1.59

A high quick ratio indicates there is a cushion against drastic losses in case of business failure.

Debt to Equity Ratio – A Measure of Leverage (Debt)

Debt to Equity Ratio is a measure of the extent to which a firm employs debt to finance. The more debt a firm employs, the more “leveraged” it is said to be. The higher the leverage, the higher the risk (risk of default). Also, the interest payments will lower earnings resulting in lower shareholder equity. This formula measures the proportion of lender’s claims to stockholder’s claims. Here is the formula:

Debt to Equity = Total Long-Term Debt ÷ Shareholder’s Equity

Debt to Equity = $16,962 M ÷ $120,179 M = 14.41%

Income Statement (Earnings Statement)

The Income Statement presents the flow of Revenues and Expenses in a given year. Compared to the Balance Sheet, the Income Statement gives a more detailed answer to a critical question for any investor: is the company making money?

The well-known expression “the bottom line” comes from Income Statements. Specifically, it matches the Revenues in a given period to the Expenses in that period to calculate profitability, or Net Income (Revenue – Expenses).

While the bottom line Net Income is obviously an important figure, a good analyst will review an income statement line-by-line. There may be little bits of good news or red flags revealed along the way to calculating that final profitability figure that can give an indication of a company’s financial health.

Let’s look at the Annual Income Statement for Apple, ending March 29, 2014:

We can see that Apple had Total Revenues of $176.0 B, Costs of Revenue of $109.3 B, Taxes of $13.4 B, Other Expenses (net of Other Income) of $15.6 B, and a Net Profit Applicable to Common Shares of $37.7 B.

Time to pull out your calculators and have fun with some calculations and ratios! Please follow along:

Understanding Income Statement Analysis

Gross Income – A Measure of Production Profitability

Gross Income is calculated by subtracting the cost associated with generating revenue (Cost of Revenue) from Revenue itself. Cost of Revenue excludes cost not associated directly with manufacturing the product, such as Administrative Cost, Research and Development, and Interest Expense.

Gross Income is an excellent indicator of the profitability of the products sold. Here is the formula:

Gross Income = Revenue – Cost of Revenue

Gross Income = $176,035 M – $109,347 M = $66,688 M

Gross Margin – Percent Revenue Which is Profit

Gross Income plays an important role in calculating Gross Margin. Gross Margin is a ratio that measures the percentage of revenue that is profit after we pay for the costs associated with producing it. Here is the formula:

Gross Margin = Gross Income ÷ Revenue

Gross Margin = $66,668 M ÷ $176,035 M = .3788 or ~37.9%

Simply stated, 37.9% of the revenue generated from sales is profit. This profit can be used to distribute to shareholders, to pay down debt, or to fund new business growth opportunities. The remaining 62.1% covers the cost of goods sold. A company with a consistently higher gross margin makes more profit for every widget sold, which is a distinct competitive advantage.

Earnings Per Share (EPS) – Profitability per Share of Stock

Earnings Per Share (EPS) refers to the total amount a company earned in a given timeframe, divided by the number of outstanding shares. EPS is one of the most-quoted indications of a company’s current health.

Given that Apple’s outstanding shares on March 29, 2014 were 861.38 M, we can calculate EPS:

EPS = Net Income ÷ Number of Shares

EPS = $37,707 M ÷ 861.38 M = $43.8/share

Note: there are numerous ways that investors calculate earnings per share. Some include all stock options and convertible bonds to calculate a Diluted EPS (which is $41.73/share for Apple). Some may use a weighted average number of shares outstanding for a given period of time. It is beyond the scope of this article to explain all the nuances; for now, it is good enough to understand the fundamentals of how it is calculated and why it is useful.

Price-to-Earnings Ratio (P/E) – Our Cost to Share in Earnings

Investors buy a share of a company in order to get a share of the earnings, and therefore, you should want to know how much you are paying for that privilege. P/E can be a handy yardstick for whether you are paying dearly to tap a company’s earnings stream, or whether you are getting a bargain.

P/E is calculated by taking the price of the stock and dividing it by the EPS. P/E is always quoted using annual earnings.

Given that Apple’s Stock Price was $604.65 on March 29, 2014, here is the calculation:

P/E = Share Price ÷ EPS

P/E = $604.65/share ÷ $43.8/Share M = 13.8

Note: Using Apple’s Diluted EPS of $41.73, the P/E ratio is ~14.5.

Price/Earnings-to-Growth (PEG) – Includes Future Growth

PEG is the comparison of the P/E ratios of various stocks. The P/E and EPS give us only a snapshot of the past. PEG is an earnings ratio that tries to account for future growth. It is calculated by dividing the P/E ratio by the annual EPS growth rate.

Assuming a 15.76% growth rate for Apple, here is the calculation:

PEG = P/E Ratio ÷ Annual EPS Growth Rate

PEG = 13.8 ÷ 15.76 = .875

Note: Using Apple’s Diluted EPS of $41.73, the PEG is 0.92

EBITDA – Earnings Before Interest, Taxes, Depreciation, Amortization

EBITDA is the calculation of net income with interest, taxes, depreciation, and amortization added back to it. It can be used to analyze and compare profitability between companies and industries because it eliminates the effects of financing and accounting decisions. Sometimes, it is quoted right on a company’s financial statement, but if it isn’t, it is simple to calculate.

Assuming Apple’s Depreciation and Amortization of $6,695 M (included in the Income Statement but not shown as a separate line item), here is the calculation:

EBITDA = Net Income + Interest + Taxes + Depreciation/Amortization

EBITDA= $37,707 M + $13,398 M + $6,695 M = $57,800 M

Cash Flow Statement

The Cash Flow Statement helps investors answer questions like: Is the company generating enough cash needed to fund growth? Or is growth outpacing cash generation, requiring additional financing? Is the company generating enough cash to cover its short-term needs? Can the company generate sufficient revenues to cover its immediate obligations?

The Cash Flow Statement is slightly different from the Income Statement and, though the preponderance of investment analysis focuses on the Income Statement (profitability), we should not overlook the Cash Flow Statement. There are several profitable companies that have gone out of business because they were unable to pay their obligations.

The key difference between the Cash Flow Statement and the Income Statement is in the concept of “matching” expenses to the time of usage.

The Cash Flow Statement measures the cash inflows and cash outflows much the same way that you balance a checkbook. You get a paycheck — that’s a cash inflow. You pay your bills — that’s a cash outflow. This is very straightforward.

The Income Statement applies accounting policies and procedures to try to best “match” the expenses to the usage of the equipment that is used to manufacture product. In this way, it is a good measure of profitability.

For example, let’s say you make a large purchase in cash, such as a $40,000 Nissan automobile, and you are expecting to be able to drive it for ten years.

On the Cash Flow Statement, this would be a negative cash outflow of $40,000.

On the Income Statement, this would show as a $4000 annual depreciation expense for the next ten years (using a very simplistic depreciation method). Do you see how the Income Statement is “matching” the expense to the time period that the asset is expected to be used?

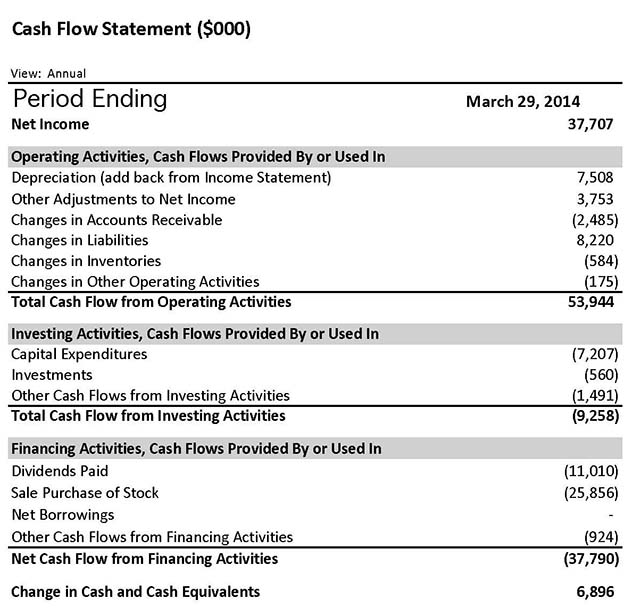

Let’s see how Apple is doing on cash flow. Refer to Apple’s Cash Flow Statement (below) and notice that there are three key sections: Operating Activities, Investing Activities and Financing Activities. In each of these sections, we measure the cash inflows and the cash outflows.

In the Operating section, the Depreciation, Depletion, and Amortization is a non-tangible expense. Meaning, these costs impact the company’s reportable profitability (net income), but are accounting functions, rather than cash flows out of the company. These can be called paper losses.

Investing Activities consist primarily of capital programs, where a company may purchase new fixed assets such as equipment or additional plants. This capital cost is a cash outflow. The investing section of a cash flow statement may also include new assets acquired during a merger, or disposal of fixed assets that were previously on the books, and other items.

These Investing Cash flows are typically depreciated on the Income Statement (much the same way as the car purchase example we talked about previously) to reflect an annual expense which matches the year of usage.

Financing Activities primarily include dividends, change in debt levels, and sale/purchase of stock.

A quick glance at Apple’s Cash Flow Statement shows that they generated ~$53.9 B (cash inflow) and spent ~$9.3 B for new investments, paid $11 B of dividends, and bought back stock of ~25.9 B. They generated $6.9 B of cashflow in excess of their expenses!

Let’s look at some analysis — pull out your calculator and follow along:

Understanding Cash Flow Analysis

Operating Cash Flow – Internal Cash Flow From Operations

This is often called Cash Flow from Operations and it is the company’s key source of cash generation. It is the cash that the company produces internally, prior to any investing and financing activities. If a company is living within its means, this is the source of cash that will pay for new growth programs (investing activity; Capital) and stockholder dividends (financing activity).

For Apple, the Cash Flow from Operations is $53.9 B and no calculation is necessary.

Free Cash Flow – Cash Flow After Capital

Free Cash Flow takes the Operating Cash Flow and subtracts from it the Capital Expenditures. This is the Cash Flow that is “free” after paying for operations and new investments. A steady, consistent generation of free cash flow is a highly favorable investment quality. It means a company is able to continue to fund its operations with some excess cash to either pay for dividends or reduce debts and obligations. Here is the formula:

Free Cash Flow = Operating Cash Flow – Capital

Free Cash Flow = $53,944 M – $7,207 M = $46,737 M

Free Cash Flow Coverage – Likelihood of Excessive Borrowing

The Coverage Ratio is simply a ratio of the Free Cash Flow to Operating Cash Flow. It shows if a company’s cash generation is in a strong position to avoid excessive borrowing, expand its business, pay dividends and to weather hard times. The higher the ratio, the stronger the Company. Here is the formula:

Free Cash Flow Coverage = Free Cash Flow ÷ Operating Cash Flow

Free Cash Flow Coverage = $46,737 M ÷ $53,944 M = $86.6% M

Only 13.4% of Apple’s Operating Cash Flow was required for Capital, leaving 86.6% available for financing activities or to increase assets on the balance sheet. We would conclude that there is little risk of insolvency. But on the flip side, too high of a coverage ratio could indicate that the company has a limited number of new projects, resulting in low long-term growth.

One more statistic I find particularly relevant is Float. To an investor, float generally refers to the total number of shares available for trading. Float is calculated by subtracting closely held shares and restricted shares from the total number of outstanding shares. That way we get an accurate account of how many shares are actually available for trading.

Key Statistics Are at Our Fingertips

We have covered the basics of how to interpret Financial Statements. Now, I’ve got some great news for you. You don’t have to calculate all of those ratios and metrics yourself!

Though we need a solid understanding of the basics, the heavy lifting of analyzing and normalizing each company’s financial statements can be found through multiple online sources.

Our goal is to efficiently utilize this data and convert it into profit through making smart investment decisions.

For example, here is a table of Key Statistics for Apple from a free online source that I commonly refer to:

There are many resources from which we can find the Key Statistics by which we can analyze stocks: Google Finance, Yahoo Finance, all of the online brokerages.

This table is an example from Yahoo Finance, and it includes Valuation Measures, Financial Highlights, and Trading Information.

In this table, you will see that there are many ratios which we have not discussed, but that other investors may use to help influence their decisions.

Every trader will have his or her own favorites, such as Price/Sales, Price/Book, Profit Margins, Operating Margins, Return of Assets, Return on Equity, and various others.

As you gain familiarity with financial statements and become adept at trading, you too will develop a short list of key metrics and a disciplined process to help you make judicious decisions. You will develop your own personal investment strategy that fits your purposes.

Fundamental Analysis: An Approach to Investment Selection

Fundamental Analysis is important because it helps to identify stocks with key growth and stability characteristics. By conducting a fundamental analysis on a company, investors can reduce or limit the emotion that comes with an investment decision; a stock either passes a fundamental screening or it doesn’t.

Fundamentals tell the history of a company, the good and bad about financial stability and strength, about budgeting and risk-taking, all of which will help to reduce risk by predicting the company’s capacity to perform in the present and in the future. Good fundamentals provide a solid foundation on which companies can build.

Some Brokerage Houses recommend making a Report Card for every intended purchase.

In the pursuit of this objective, they have devised scoring systems by which investors can quantify all of the data which is included in a Fundamental Analysis.

While you can use one of their scorecards, or develop your own, this sample Report Card and the following discussion defines the criteria for a grading system. It is meant to show you an approach such that you are better empowered to develop and customize a method that fits your needs.

This particular Report Card is broken into two Phases. Phase 1 is used for preliminary screening based on financial strength using 13 key ratios as a criteria. Phase 2, which we will discuss next, is a more detailed review of a short-list of those companies that passed the Phase 1 scoring criteria.

Phase 1 Report Card

Using the Phase 1 Report Card (above), the 13 ratios are calculated and scored with either an Up Green Arrow (strong performance), Down Red Arrow (weak performance), or no arrow (middle of the road).

Good stock choices will have at least five strong performing green arrows and not more than two weak performing red arrows. When those are identified, we put them on a watch list for further review in Phase 2.

Though these ratios are calculated using online resources or brokerage services, we are responsible for understanding what they mean and why they are significant. These ratios serve as our foundation, our stepping stones, to move viable stocks to the next phase of analysis.

Volume Ratio 5/30 Day: The ratio of the most recent 5 day average volume to the 30-day average, expressed in percentage terms, meaning a score of 100 equates 100 percent of the average volume.

P/E Ratio: The ratio of a stock´s price to its (trailing year) earnings per share.

P/E Relative Ratio: The ratio of a stock´s P/E to its historical high and low P/E. The historical high and low P/E´s can be determined if five years of data is present. Values range from 0-100, with 0 indicating an all-time low valuation and 100 indicating an all-time high valuation.

Proj EPS 1M Chg CFY: One month change in projected earnings per share.

EPS Growth 5 yr: The change in EPS from the specified time frame. Values are expressed in percentage terms (e.g. 1=1%) with rising profits represented by positive numbers.

Company Growth Ratio: A ratio of ratios that compares a forecasted P/E ratio to a projected P/E ratio. The forecasted P/E ratio is based on analyst predictions for a given company, while the projected P/E ratio is based on recent quarterly performance of that same company. If analysts expect the company to grow more rapidly than it has historically, then this ratio will likely show values higher than 1.0. Ratios below 1.0 imply that analysts are projecting the company’s earnings to slow in comparison to its historical performance.

Acc.Dist Current: Accumulation/Distribution is an indicator that measures whether big money has been entering or exiting the stock recently. If the stock has been rising on the days volume is above average, then Acc/Dist increases, which is a sign that big money is quietly entering the stock. If on the days of above-average volume the stock has been trending downward, it is a sign that big money is exiting the stock.

Cash Flow Growth 5 Yr: The change in cash flow for the specified period. Values are expressed in percentage terms (e.g. 1=1%) with rising cash flow represented by positive numbers.

Debt/Equity Ratio: This ratio is Total Debt for the most recent interim period divided by Total Shareholder Equity for the same period. Note: This ratio is not meaningful if you are analyzing a bank.

Insider Trading: This reveals the number of net purchases by insiders (that is, the number of insiders’ purchases minus the number of insiders’ sales totaled over a 3-month period).

EPS Rank: This combines a company´s earnings performance over the past five years into a single indicator so that it can be used to rank earnings momentum against all other companies. Values range from 99.9 (positive momentum) to 0 (negative momentum).

Price Rank: This measures a stock’s price performance based on a weighted sum of quarterly returns, with heaviest emphasis placed on the most recent three months. Strong price ranks can have scores in excess of 70 and low price ranks can have scores below 30.

Group Rank: Group Rank measures an industry group’s strength over six months, using the sum of the group’s relative performance, with the heaviest weighting on the most recent three months. A score of 70 or higher reveals a very strong group that has outperformed at least 70% of other industry groups in the market. A score of 30 or lower reveals a weak group that has underperformed at least 30% of all industry groups in the market.

Phase 2 Report Card

The Phase 2 Report Card assesses future estimates by analysts about the company’s ability to promote and increase its sales and earnings. It is a more detailed review that we should perform on those companies that pass the Phase 1 screen.

The Phase 2 Report Card consists of four key areas to review: A) Financials, B) Analyst Estimates, C) Price Pattern, and D) Volatility. The F/E Score on the report card is the average of the Financial and Estimates scores. In addition to these four areas, we will also include E) Current News in our scoring as well.

A. Financials

The Financials analyze a company’s past and present performance. To determine the Financials score, there are four things to be considered:

- Return on Equity (ROE): How effectively has management employed investor equity to grow profits?

- Growth Rates: How quickly have the company’s sales grown?

- Revenue: How much revenue does the company generate before expenses?

- Earnings per Share (EPS): How much is the company making in profits per share of stock?

After running the analysis, Apple scored a 3.5 in Financials.

(Note: It is beyond the scope of this article to illustrate all of the calculations in the Phase 2 Report Card. This is a sample scorecard generated from a web-based software. For now, it is sufficient for us to review and get familiar with the concept of scorecards.)

B. Estimates

The Estimates score, also known as Earnings Estimates, are what professional analysts who are employed by investment companies forecast for the company’s future earnings and overall growth rate.

There are four key components that we evaluate, which are averaged together, to calculate the final Estimates Score: B1) Wall Street Estimates, B2) Company vs. Industry EPS Growth Rates, B3) Historical Surprises, and B4) Analyst Recommendations and Revisions.

Let’s review each category:

B1) Wall Street Estimates – Use the table below to answer the following questions and calculate a score:

Step 1: Answer the Questions:

- Do the year-over-year earnings estimates in the Mean row increase? If yes, the number in the Next Fiscal Year End column should be larger than the number in the Current Fiscal Year End column. Answer: Yes, 47.76 > 42.86.

- Do the quarter-over-quarter earnings estimates in the Mean row increase? If yes, the Next Quarter End number should be larger than the Current Quarter End number. Answer: Yes, 9.53 > 9.48.

- Look for a number above 20% in the Mean row of the Next 5 Year Growth column.

Answer: No, 18.62% growth rate is lower than 20%. - Positive numbers (upgrades) in the Mean Change row are good, while negative numbers (downgrades) are a cause for concern. Answer: Yes, they are positive.

Step 2: Score the Answers:

Questions one and two should be scored together, not individually. If either of those two questions is a “no” then take off one point. For Apple, one point was lost due to a lower than 20% expected 5 year growth rate. Wall Street Estimates, which is the first section of the Estimates, scores 3.0 (B grade).

B2) Company vs. Industry EPS Growth Rates – Compare how fast the company’s EPS have grown and are expected to grow, with the average EPS growth rates in the industry and other indices.

Refer to the table and answer the questions for Apple:

Step 1: Answer the Questions:

- Is the number in the Company row in the Last 5 Years Actual column, larger than the number in the Industry row? Answer: Yes, 64.95% > 57.16%.

- Is the number in the Company row in the Current/Last column, larger than the number in the Industry row? Answer: Yes, 55.53% > 54.06%.

- Is the number in the Company row in the Next/Current column larger than the number in the Industry row? Answer: Yes, 12.66% > 12.62%.

- Is the number in the Company row in the Next 5 Years column larger than the number in the Industry row. Answer: Yes, 18.62% > 17.09%.

Step 2: Score the Answers:

In each of the following, meeting the criteria means keeping the score as 4.0 (A grade), while failing to meet the criteria means dropping the score one point. The Company vs. Industry EPS Growth Rates, the second section of the Estimates, scores 4.0 (A grade).

B3) Historical Surprises – Public companies announce earnings once every quarter. Prior to these announcements, Wall Street analysts predict what they believe these earnings will be. The analysts are usually pretty close in their predictions, but every now and then, a company surprises Wall Street with its earnings.

These surprises can be positive or negative. Positive surprises are generally good for a stock’s price, while negative surprises are usually bad. Consider looking for companies that consistently meet or beat analyst estimates each quarter.

Let’s learn how to score these surprises using Apple as an example. Please refer to the following table:

Step 1: Answer the Questions:

-

- If the number in the Actual column in the first row is larger than the number in the Estimate column, it is a beat. Answer: Yes, Beat! 13.87 > 10.16; Jai Maa!

- If the number in the Actual column in the second row is larger than the number in the Estimate column, it is a beat. Answer: No, Whoops! 7.05 < 7.39.

- If the number in the Actual column in the third row is larger than the number in the Estimate column, it is a beat. Answer: Yes, Beat! 7.79 > 5.84; Jai Maa!

- If the number in the Actual column in the fourth row is larger than the number in the Estimate column, it is a beat. Answer: Yes, Beat! 6.4 > 5.38; Jai Maa!

- If the number in the Actual column in the fifth row is larger than the number in the Estimate column, it is a beat. Answer: Yes, Beat! 6.43 > 5.40; Jai Maa!

Step 2: Score the Answers:

Count the number of Yes scores. That is the grade! Apple scored a Yes four times which gives them an overall score of 4.0 (A grade) in Historical Surprises, the third section of the Estimates score.

B4) Analyst Recommendations and Revisions

Looking at analyst recommendations can help determine what to think of a company’s future prospects. For the stock to score well in this section, consider finding analysts who are recommending to “Buy” the stock. Refer the table below and answer the questions:

To score Analyst Recommendations and Revisions, find the Mean Rating number in the Current column and score it according to the following scale:

1.0–1.5 = A

1.6–2.5 = B

2.6–3.5 = C

3.6+ = F

In this example, AAPL has a rating of 1.55, which gives it a 4.0 (A grade) for Analyst Recommendations and Revisions.

Calculating the Estimates Score

We have now completed all four sections under Estimates and it’s time to tally the score. After scoring each of the four Estimates categories individually, combine the scores and calculate an average. First, take all four scores and add them together, then divide by four.

Using the following scores from AAPL in this example, you can discover the final Estimates score:

B2) Company vs. Industry EPS Growth Rates 4.0 (A grade)

B3) Surprises 4.0 (A grade)

B4) Recommendations and Revisions 4.0 (A grade)

TOTAL 15.0

Final Estimate Score = Total Estimate ÷ 4

15 ÷ 4 = 3.75

Next, include the 3.75 on the Report Card for Estimates and calculate F/E:

F/E = (Finance + Estimates) ÷ 2

F/E = (3.5 + 3.75) ÷ 2 = 3.62

C. Price Pattern

The Price Pattern indicates whether the stock has been moving up, down, or sideways. To score 4.0 (A grade), the stock must have been moving upward on both one-year and five-year charts. If the stock was primarily moving sideways, it scores 2.0 (C grade). If the stock was moving downward, it scores 0.0 (F grade).

Apple’s score on Price Pattern is 2.75.

D. Volatility

Volatility shows how fast the stock has moved up and down on a daily, weekly, and monthly basis. Scoring volatility helps investors determine how comfortable owning the stock will be. The higher the volatility, the higher the risk.

The next step in this systematic process is to assess the Volatility score, which indicates risk and measures the magnitude of a stock’s price movements up and down in a given time period. The Volatility score provides an idea of how wide the stock’s price swings may be in the future.

Looking at a chart’s price movements can be helpful in preparing for the experience of owning a particular stock. On average, monthly price movement of 10% to 20% is considered normal for some stocks, but for others, the price may fluctuate even more.

Analysts score Volatility based on how a stock compares to the baseline average. To arrive at this average, analysts look at the price movement of all stocks which could be optioned during the past year and measure how fast they move up or down on a monthly basis.

Then we compare its volatility to a baseline average, and calculate the Volatility score for that stock according to the following criteria:

If the stock has the SAME or has LESS volatility as the large basket of stocks, it scores 4.0 (A grade). The lower the volatility score, the MORE volatile the stock is. If the stock scores BELOW 2.0 (C grade), it could be a warning sign.

Apple’s Volatility Score is 3.0.

E) News Scores

A News Score is one additional metric worthy of our attention, though it is not included on this particular Report Card. News describes the current events with a company at the present time.

Recent company news can affect the overall Phase 2 score positively or negatively in the near-term. While an increase or decrease in earnings may be the result of an event from months past, the current news offers information about what is happening with a company right now.

When examining the news, investors should determine whether the information is good or bad in terms of how it might impact the stock.

Good News: News is considered good when a company announces it beat earnings estimates, received a significant contract, opened new facilities, and so on. Such events might indicate that the company is moving in a direction of increased revenue and earnings, which is always good.

Bad News: News is considered bad when a company doesn’t meet earnings estimates, someone files a class action lawsuit against the company, or it loses a major contract. These kinds of events might negatively impact the stock.

Step 1: Read the headlines:

Begin by reading headlines for the company’s name or stock symbol. These may be generally positive, like earnings reports, new product announcements, and so on, or generally negative, like a drop in earnings. If you want to read an entire news story, click its headline to load the full article.

Step 2: Score the News:

As you read the headlines and appropriate articles, you score the News as either “pass” or “fail.” Before a news item can fail, there must be sufficient negative evidence. In fact, the following two things must happen:

1. Negative news must occur (bad earnings, losing a major contract, etc.)

2. The stock must go down as a result of that bad news.

Both conditions must apply before giving the News a failing grade. It may seem intuitive that if negative news occurs, a stock will go down. But what an investor might consider to be negative news, the market might not care about, because it has already absorbed or factored that news in. Remember, news drives stock prices to the extent that it is new news or different from what was expected.

These are the key ingredients to Fundamental Analysis, following which we are sure to find strong companies with good prospects for the future.

Many investors spend more time researching a new handbag or a pair of shoes, then they do researching their investments. But if we are prudent, and invest the time in research and analysis, we have a much more substantial chance to capitalize on investment opportunities.

Remember, we do not have to be right all the time. We only need to be right more times then we are wrong, and then investments will yield a profit.

Now that we are familiar with the Fundamental Analysis of investing, our next article will look at the Technical Analysis.